Pay in Person

Treasury Division - Cashier's Counter

Dearborn Administrative Center

16901 Michigan Ave, Dearborn 48126

Hours: Monday-Friday, 8am - 4:30pm

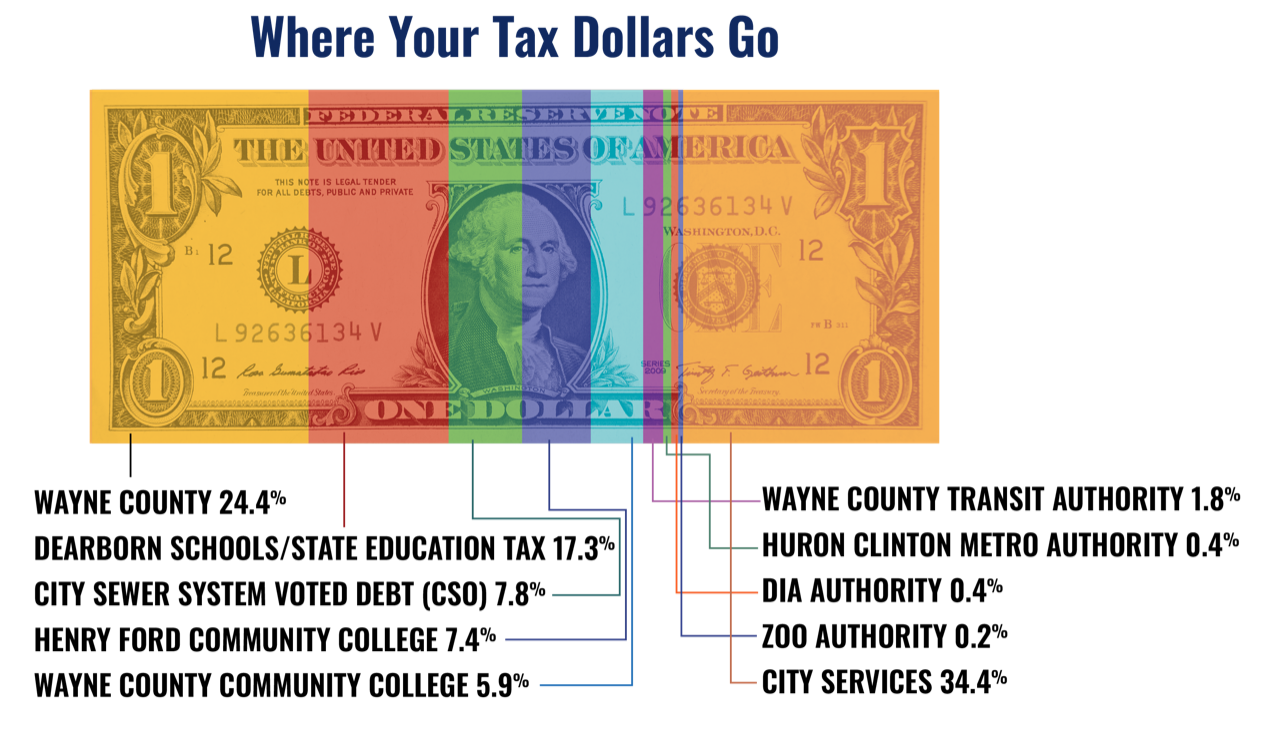

The City of Dearborn uses property tax dollars to provide high-quality services to residents and businesses.

Property Assessment & AppealsProperty taxes are billed twice annually by the City of Dearborn.

The City offers a variety of options for residents to pay property taxes and utility bills.

Residents may pay property taxes, miscellaneous invoices, special assessment bills, and delinquent personal property taxes online using the BS&A website. This service is free to City of Dearborn property owners who create and account and register their property. If you are an occupant of a property, but not the owner, you will need to create an account to access tax information for a $6 fee.

If residents pay with a credit or debit card, a 3% convenience fee is charged on the full transaction amount. If residents pay by e-check, there is a $3 convenience fee charged.

The Divdat Mobile Payment App is also available and runs on both Apple/IOS and Android platforms. Search Divdat in your app store and download in order to make an e-check or credit card payment. Call your bank to ensure proper ABA and account information.

Residents paying by credit card or debit card will incur a 3% convenience fee. E-Checks are free.

The City of Dearborn offers residents the option to set up automatic payments for property taxes with a direct withdrawal from a bank account with ACH Debit (Automated Clearing House). This payment option is free.

Residents have the option to cancel their participation in the automatic payment program at any time.