Passing the City’s Budget

The process to pass the City budget traditionally involves the following steps:

The City of Dearborn is responsible for passing a budget annually by June 30 to fund the City and its operations for the coming fiscal year, which begins on July 1 each year.

FY 2026 Budget Hearing ScheduleThe following budget documents apply to Fiscal Year 2026 (FY2026), which begins on July 1st, 2025, and concluding on June 30th, 2026.

The following budget documents apply to Fiscal Year 2026 (FY2026), which begins on July 1st, 2025, and concluding on June 30th, 2026.

The City is required to maintain budget documents for the past seven years, plus the current year.

The City of Dearborn observes a fiscal year of July 1 - June 30. This means that the City must pass funding for the upcoming fiscal year, which includes anything occurring between July 1 and June 30 of the next year, by June 13th each year.

The Mayor submits budget recommendations on behalf of City departments and staff and then works with the City Council and the City’s Finance Department to shape and balance the proposed budget, as needed. The City’s budget is voted on (adopted) by Dearborn’s seven-member elected City Council.

The Finance Department supports the Mayor’s Office and City Council in drafting and passing a budget and ensures transparency and accountability throughout the process.

The Annual Comprehensive Financial Report (ACFR) is completed after the City Fiscal Year ends. This report contains the financial statements, schedule expenditures for federal awards, and audit opinions. An additional Single Audit report is also available.

The most recently completed audit was FY2025. The City received an Unmodified Opinion (best opinion), noting that the financial statements are presented fairly in all materials and in accordance with accounting standards.

Please note: This year’s Single Audit is issued as a separate document. Normally included in the ACFR, it was released independently in FY2025.

The City is required to maintain budget documents for the past seven years, plus the current year.

Annual Administrative Reports outline departmental successes and operating information for the Fiscal Year reported. The City is required to maintain these reports for the past seven years, plus the current year.

The City of Dearborn actively participates in Michigan's City, Village and Township Revenue Sharing (CVTRS) Program, formerly known as the Economic Vitality Incentive Program (EVIP). This program requires that the City fulfill requirements set by the state in the areas of Accountability and Transparency in order to receive CVTRS funding.

For more information on CVTRS, visit the State of Michigan Treasury Department website.

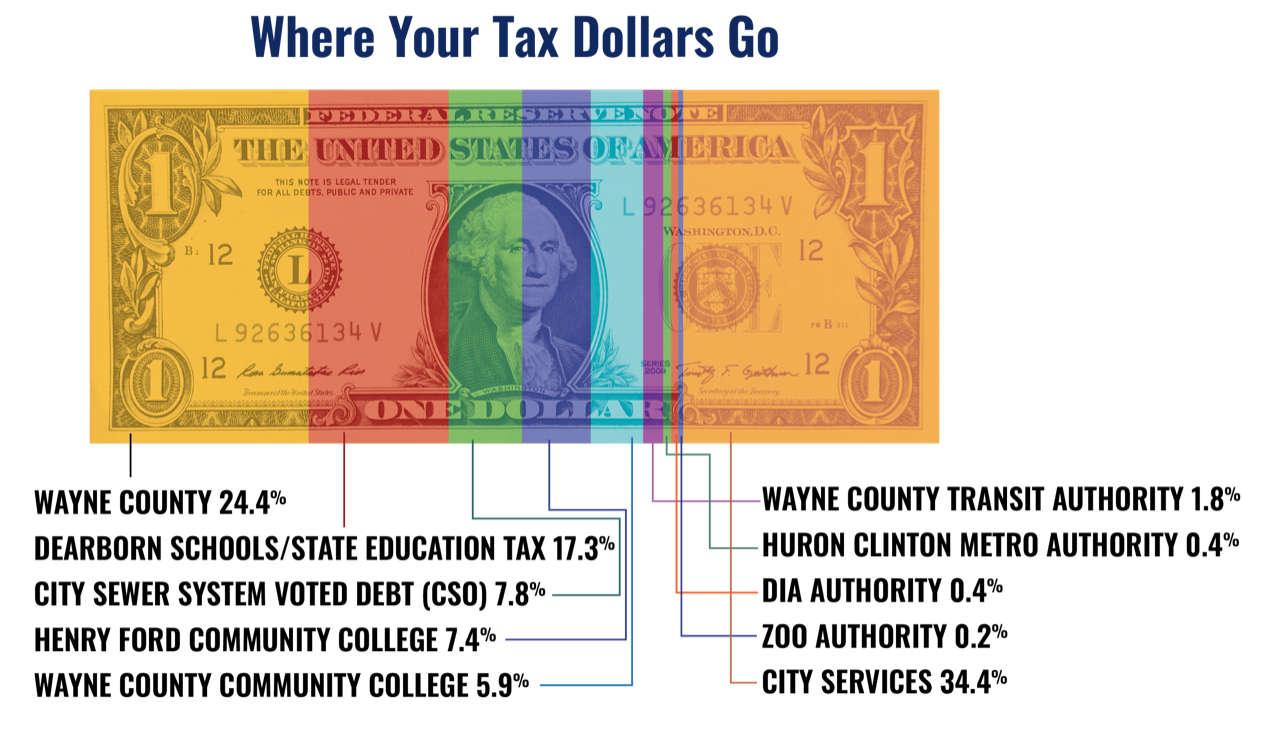

The City’s budget is funded by local tax revenue from both property and business and commercial taxes, revenue sharing from the State of Michigan, revenue from City services, and program support from Wayne County, grants, and other public sources.